14+ fcra mortgage

Congress amended FCRA with the Fair and Accurate Credit Transactions Act of 2003 FACT Act. Web RESPATILAFCRA and Mortgage-Related Litigation.

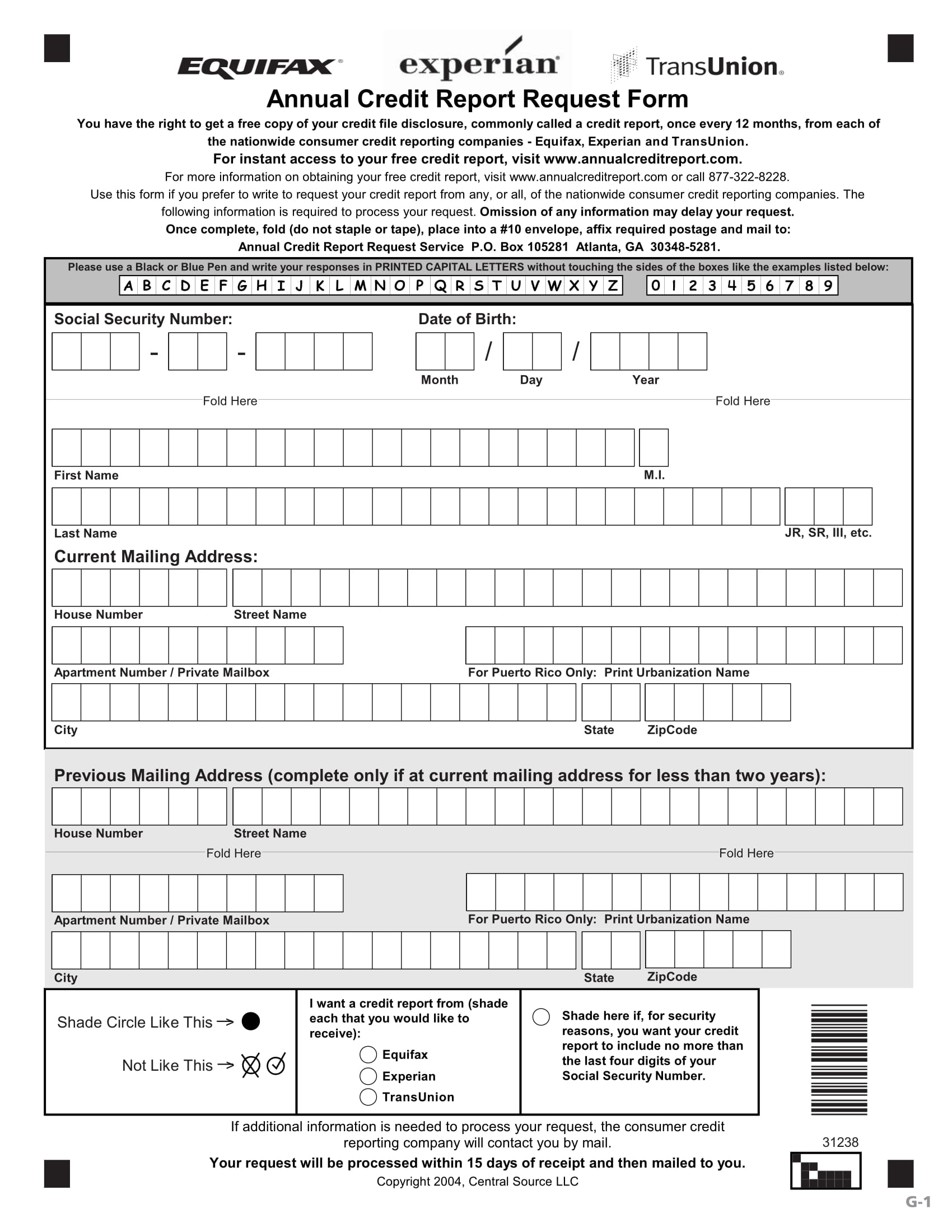

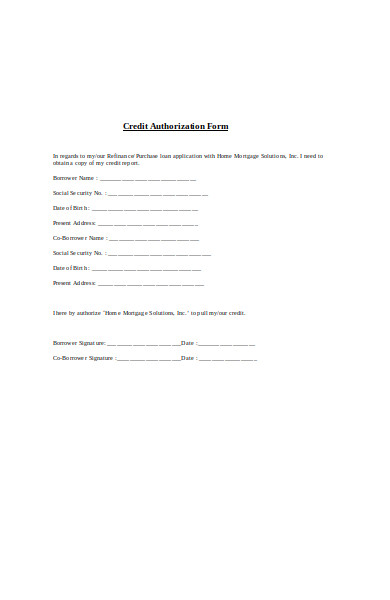

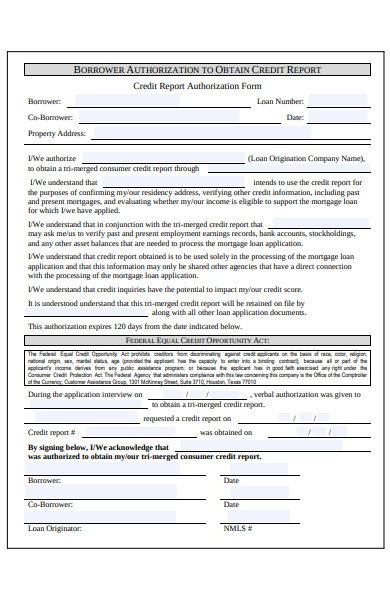

Free 13 Credit Report Forms In Pdf Ms Word

It creates consumer protections and rights and imposes.

. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Information in a consumer report cannot be provided to anyone who does not have a purpose specified in the Act. Web The Act Title VI of the Consumer Credit Protection Act protects information collected by consumer reporting agencies such as credit bureaus medical information companies and tenant screening services.

Web Under the FCRA a user of a mortgage trigger product eg a credit union community banker or other lender must. Web Even if the transaction will not be consummated for closed-end credit or the account will not be opened for open-end credit the copy must be provided promptly upon completion as provided for in 100214a1 unless the applicant has waived that deadline as provided under 100214a1 in which case as provided for in 100214a1 the copy must be. You must be told if your credit history has been used against you.

Foley has been counseling and litigating in the Real Estate Settlement Procedures Act RESPA Truth In Lending TILA. Apply Get Pre-Approved Today. Fast Approval Low APR Rates No Hidden Fees Reliable Reviews Online Comparison.

1681 et seq became effective on April 25 1971. The FCRA is part of a group of laws contained in the Federal Consumer Credit Protection Act 15 USC. Web The FCRA is designed to protect the privacy of consumer report information and to guarantee that the information supplied by consumer reporting agencies CRAs is as accurate as possible.

The FCRA And Your Mortgage As. Get Instantly Matched With Your Ideal Mortgage Lender. Web 1 day agoThe average interest rate for a standard 30-year fixed mortgage is 694 which is a growth of 15 basis points compared to one week ago.

Web A creditor must provide the section 615 a disclosure when adverse action is taken against a consumer based on information from a consumer reporting agency. Ad Calculate Your Payment with 0 Down. Companies that provide information to.

When it comes to MI it means an insurance application is denied or a higher. Web The definition of adverse action under FCRA is tied to the reason the consumer report was obtained. Check How Much Home Loan You Can Afford.

Web FCRA is intended to ensure consumer reports are accurate and used for permissible purposes. A basis point is equivalent to. Web For example if a company offers credit with APRs of 8 percent 10 percent 12 percent and 14 percent and selects the APR based on a consumers credit information.

Web The Fair Credit Reporting Act FCRA 15 USC. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Furnishing and Reporting Old Information.

The FCRA requires landlords who deny a lease based on information in the applicants consumer report to provide the applicant with an adverse action notice. Ad Compare Home Financing Options Get Quotes. Lock Your Rate Today.

If a lender uses a credit report to make a decision to deny your loan the lender must tell you and must give you the name address and phone number of the agency that provided the credit information. 1601 et seq. There are several common violations of the Fair Credit Reporting Act involving both the thousands of companies reporting information and the three major bureaus taking the information and assigning it to your credit report.

Web Enforcement Showhide Enforcement menu items. Web i A consumer who obtains a mortgage from a mortgage lender authorizes or requests information about homeowners insurance offered by the mortgage lenders insurance. Web The FCRA requirements apply to major consumer credit bureaus employers banks and credit unions landlords and more.

Web The FCRA Summary of Rights offers the following protections related to mortgage lending. Ad Compare the Best House Loans for February 2023. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Ad Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offer. A Certify to the consumer reporting agency that it has a. Web Mortgage lenders must consider your credit score when deciding whether to approve you for a home loan so they will need to access your credit.

Compare Apply Directly Online. Web Fair Credit Reporting Act Violations. Some of the common violations include.

Melissa Cleary Vp Audit Manager Citi Linkedin

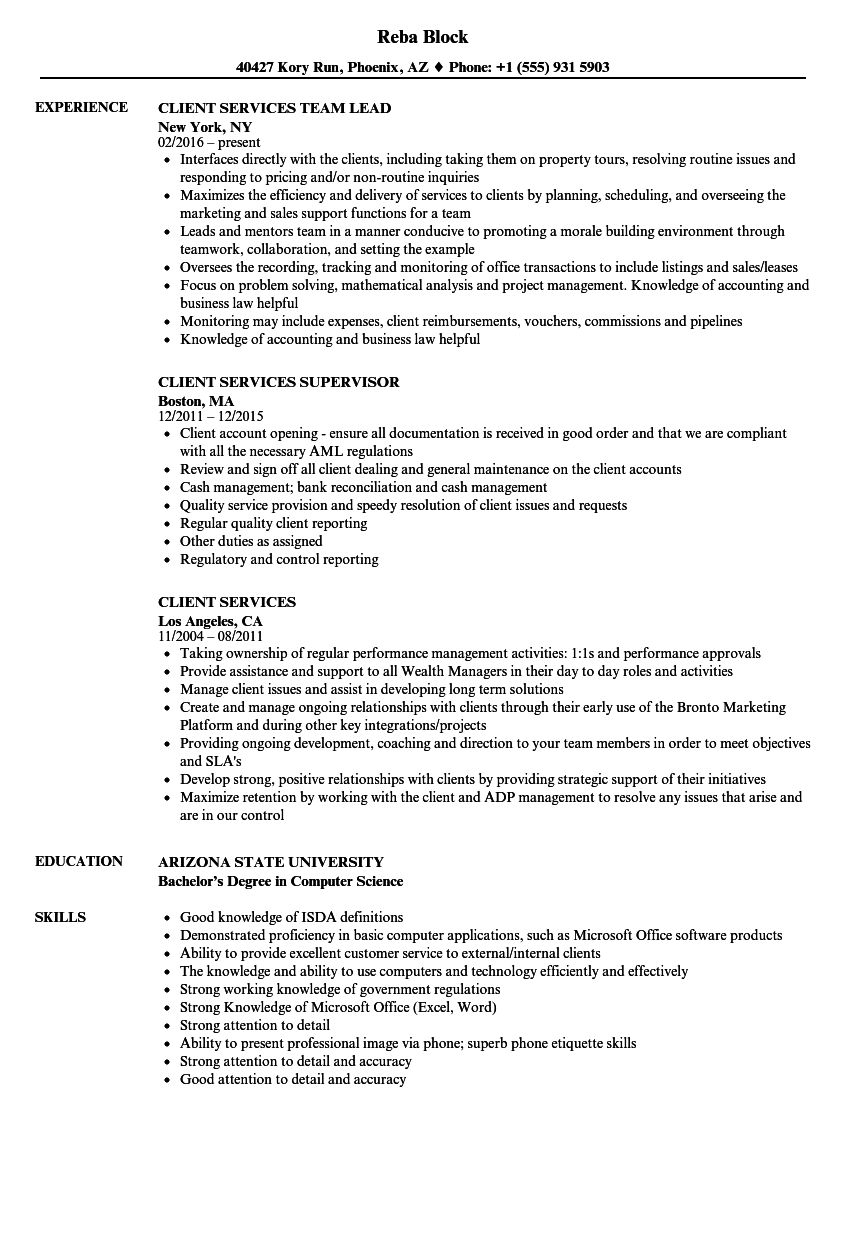

Client Services Resume Samples Velvet Jobs

Client Services Resume Samples Velvet Jobs

What Day Does Bank Of America Report The Credit Card Balances To The Credit Reporting Agencies Quora

Free 10 Credit Report Authorization Form Samples In Pdf Ms Word

Who Is The Best Credit Repair Guru Quora

The Level Of Detail On Twn Is Scary R Overemployed

What Day Does Bank Of America Report The Credit Card Balances To The Credit Reporting Agencies Quora

Thuan Lam Crcm Mba Senior Compliance Officer American Advisors Group Linkedin

Free 10 Credit Report Authorization Form Samples In Pdf Ms Word

Client Services Resume Samples Velvet Jobs

Thuan Lam Crcm Mba Senior Compliance Officer American Advisors Group Linkedin

Client Services Resume Samples Velvet Jobs

Bank Of America Said They Forced Close My Account But It Does Not Show In My Credit Report Why Quora

Fair Credit Reporting Act Regulation V Ncua

Background Verification Screening Services Wns

Client Services Resume Samples Velvet Jobs